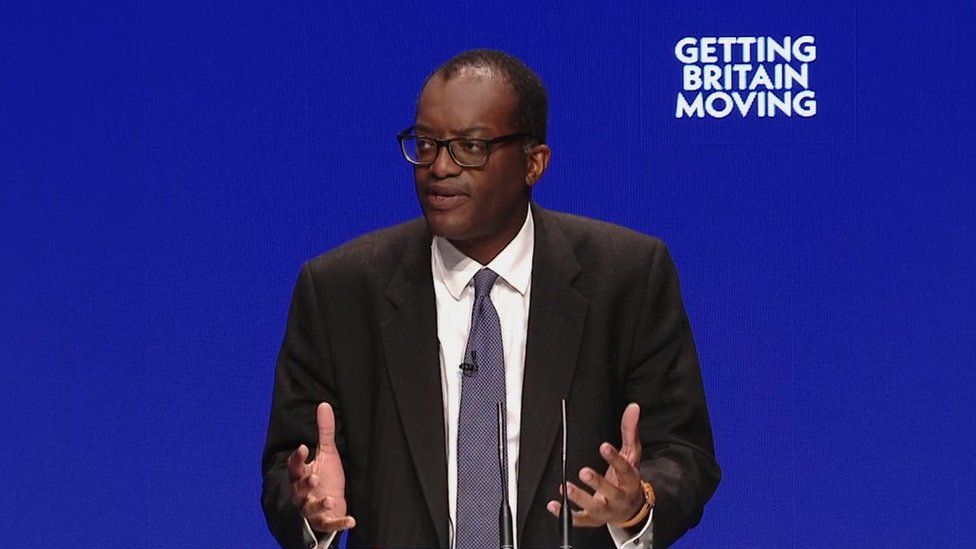

PA Media

PA MediaChancellor Kwasi Kwarteng will set out his plan to get UK debt falling earlier than planned, after markets reacted badly to his package of tax cuts.

He is expected to publish details on how the cuts will be paid for later this month despite previously insisting he would wait until 23 November.

The move follows a dramatic U-turn on scrapping the 45p rate of income tax for higher earners.

Mr Kwarteng said he wanted to “move forward” with no “distractions”.

Meanwhile, Prime Minister Liz Truss has said that abolishing the top rate of tax was only a “tiny part of the plan” for economic growth.

In a speech to the Conservative Party conference in Birmingham, Mr Kwarteng acknowledged the “turbulence” caused by his mini-budget, which saw the pound’s value plummet, borrowing costs soar, and the Bank of England bail out pension funds.

Even so, he promised to deliver the rest of his £43bn package of tax cuts, which is expected to be partly paid for by a squeeze on public spending.

Writing in The Daily Telegraph, Ms Truss said her government would “control public spending” and had a “firm commitment to fiscal responsibility”.

“The status quo is not an option,” she wrote, adding that she and the chancellor had a “clear plan for economic success and security”.

This video can not be played

To play this video you need to enable JavaScript in your browser.

The chancellor said his medium-term fiscal plan, which will outline how the government plans to cut the UK’s debt, would come “shortly” rather than at the end of November.

A source told the BBC the debt plan was expected this month on a date to be confirmed, with a formal announcement to be made on Tuesday.

On Monday afternoon, the chief secretary to the Treasury, Chris Philp, had suggested the government still intended to set out the plan on 23 November.

But Tory MPs and opposition parties had put increasing pressure on the chancellor to release the plan earlier to shore up market confidence in the UK’s economic outlook.

The BBC’s economics editor, Faisal Islam, said the move was the latest sign that the chancellor was willing to do what it takes to regain confidence lost since the mini-budget on 23 September.

Last month, as financial markets reeled from the mini-budget, the chancellor said he would set out his plan on 23 November and asked the Office for Budget Responsibility (OBR) to report back to him by that date.

Forecasts from the OBR – the UK’s independent budget watchdog – give an indication of the health of the nation’s finances. The BBC understands the government was given a draft forecast before announcing its package of tax cuts, but it has not been published.

In an unusual move, Mr Kwarteng and Ms Truss held emergency talks with the chairman of the OBR, Richard Hughes, last Friday.

This video can not be played

To play this video you need to enable JavaScript in your browser.

A few days later, on Sunday, Ms Truss rejected calls to bring forward the budget watchdog’s assessment, which she said was “not yet ready”.

“There’s no point in publishing something that’s not ready. That would just cause confusion,” Ms Truss told the BBC’s Sunday with Laura Kuenssberg programme.

But the government has changed its mind, following days of disquiet among Tory MPs, concerned about the economic fallout of the mini-budget and the Conservative Party’s dramatic slide in the polls.

Now the OBR will bring forward forecasts alongside the plan, analysing whether the tax-cutting agenda of Ms Truss can deliver the economic growth it has promised.

Another concession

This is not a U-turn on the scale of the 45p tax rate but it is another big reversal.

There has been pressure on the Treasury from Tory MPs to bring the statement forward.

The prime minister and the chancellor do not themselves appear to have said 23 November in recent days, but they have certainly allowed the impression the statement would not move from then to persist.

The chief secretary to the Treasury, Chris Philp, certainly didn’t appear to know that the date was changing, insisting on the BBC’s Politics Live that it would still be 23 November, even after the chancellor hinted towards a change in his speech.

The OBR will cost all the policies announced by the chancellor and provide new numbers for borrowing.

The budget watchdog will also publish forecasts for economic growth.

Tory MP Mel Stride, chairman of the Treasury Committee, said he had “pressed the chancellor very hard on this and to his credit he has listened”.

He said bringing the OBR forecast forward should “should calm markets more quickly and reduce the upward pressure on interest rates to the benefit of millions of people up and down the country”.

Labour’s shadow chancellor Rachel Reeves said the chancellor’s refusal to release the OBR’s forecast was “misguided and harmful”.

She said the government’s “continued failure” to publish the forecast “suggests the government has something to hide, further undermining confidence in the UK as a safe place to invest”.

-

-

4 hours ago

-