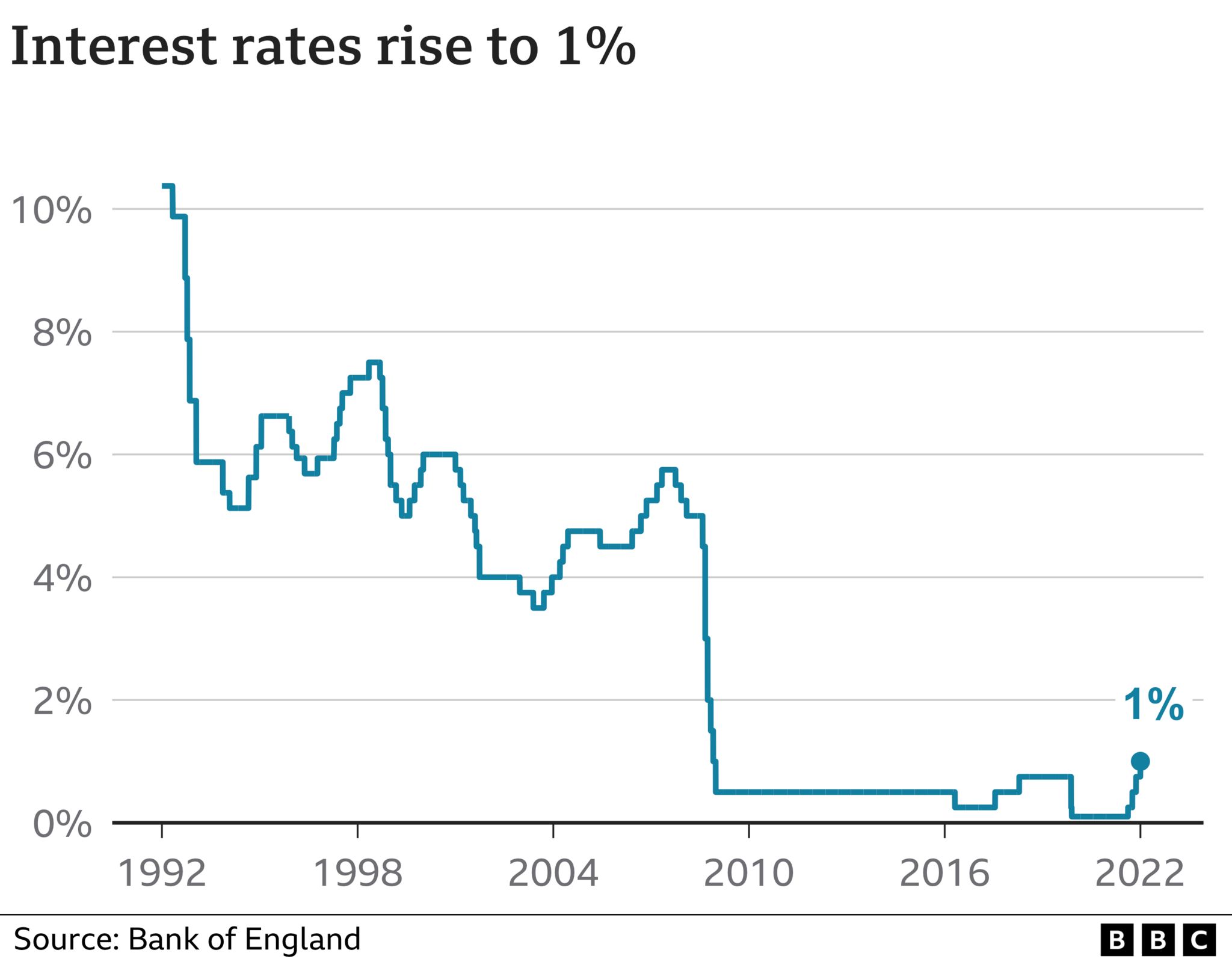

Interest rates have risen to the highest level since 2009 as the Bank of England tries to stem the pace of rising prices.

Rates rose to 1% from 0.75%, the fourth consecutive increase since December.

Inflation, already rising at its fastest pace for 30 years, is expected to breach 10% by the end of the year, with fuel, energy and food costs soaring partly due to the Ukraine war.

The Bank also warned that the UK economy is set to shrink next year.

It said inflation had “intensified” following Russia’s invasion of Ukraine, prompting households to rein in their spending which was hitting growth.

The Bank raised interest rates again to try to counter this, the fourth time it has increased them since December, as it seeks to contain the rising cost of living.

Raising rates makes it more expensive for consumers and businesses to borrow. The idea is this helps cool demand for goods and services, thereby taming prices.

But economists have warned rate rises may have little effect given the rising global oil and gas prices. The Bank’s Monetary Policy Committee (MPC) – which sets rates – also acknowledged there were “risks” in raising rates, and said it would continue to review “incoming data”.

In its latest report, the Bank predicted inflation would now hit 9% in the coming months – up from a previous forecast of 8% – and breach 10% by the end of the year.

It said the impact of the Ukraine war on household energy prices was largely to blame, following the increase in the energy price cap in April and a further expected increase in October which could push household bills up to £2,800 a year.

Consumers are also facing much higher prices for food, goods and services, it said.

“Global inflationary pressures have intensified sharply following Russia’s invasion of Ukraine. This has led to a material deterioration in the outlook for world and UK GDP growth,” the MPC said.

“UK GDP growth is expected to slow sharply over the first half of the forecast period,” it added. “That predominantly reflects the significant adverse impact of the sharp rises in global energy and tradeable goods prices on most UK households’ real incomes and many UK companies’ profit margins.”

The MPC now expects the UK economy to contract by 0.25% in 2022, down from its previous forecast of 1.25% growth. While that would not technically be a recession – defined as two consecutive quarters of contraction – it would leave the UK at a real risk of one.

The MPC has also slashed its growth outlook for 2023 to 0.25%, down from 1%.

The cost of living issue is worsening and dragging the economy into recessionary territory, says the Bank of England.

It is forecasting two quarters of falls in the size of the British economy over the next year but not the technical definition of a recession because they are not consecutive.

The big picture, though, is of an economy now forecast to contract next year, at -0.25%, having previously been forecast to grow at 1.25% in February. Even that figure was the the lowest in the G7.

Two factors are driving this. Firstly, a prediction that energy prices are going up by 40% in autumn. And secondly, government spending policy, especially the removal of the significant “superdeduction” on corporation tax that has helped support businesses investment.

At the same time, at the end of this year, inflation is expected to exceed 10%, a rate not seen since 1982. Even before the Russia-Ukraine war, the economy was facing a perfect storm of supply problems, rising prices, and slowing growth.

The war has dragged all of these measures further in to the wrong direction. The result is that interest rate decisions are especially unpredictable. The jobs market remains a bright spot for now. But more rate rises are on the way. How high they go will be tempered by an economy now going into reverse.

Russia is one of the world’s top oil and gas producers and its invasion of Ukraine has driven up global energy prices amid concerns about disruption to supplies. Russia and Ukraine are also major producers of commodities like metals, fertilisers and foodstuffs, the prices of which have also rocketed.

UK prices were already rising before the war due to the impact of the pandemic and inflation hit 7% in the year to March – the highest for 30 years and well above the Bank’s 2% target.

The MPC said it expected inflation would peak this year before falling back to 3.5% in 2023 and to 1.5% by 2024. However, it said impact of consumers tightening their belts would be felt for much longer and was something “monetary policy is unable to prevent”.

As the economy slows down, it expects unemployment to rise gradually from a low this year, to around 5% in 2024.

Its forecasts are based on market expectations that interest rates will rise as high as 2.5% in mid-2023 before falling back again.

Are you affected by UK interest rates rising? If so, please share your experiences. Email haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.