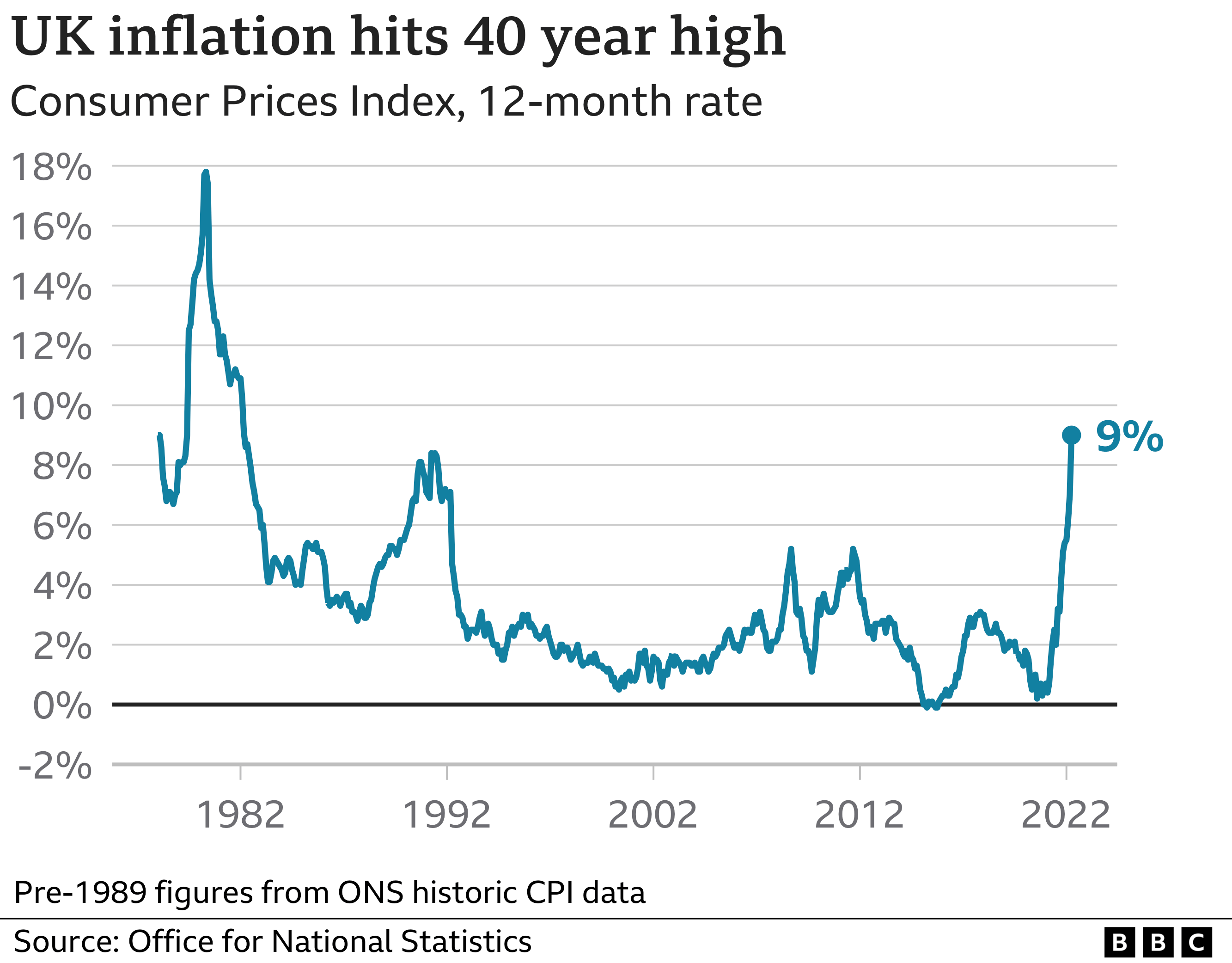

Prices are rising at their fastest rate for 40 years as higher energy bills hit millions of households.

UK inflation, the rate at which prices are rising, jumped to 9% in the 12 months to April, up from 7% in March.

The surge came as millions of people saw an unprecedented £700-a-year rise in energy costs last month.

Higher fuel and food prices, driven by the Ukraine war, are also pushing the cost of living up, with inflation expected to continue to rise this year.

Citizens Advice said “the warning lights could not be flashing brighter” for the government to issue more support for households than they are now and debt charities urged anyone finding it difficult to pay bills to seek help earlier rather than later in the year.

Around three quarters of the rise in inflation in April came from higher electricity and gas bills, according to the Office for National Statistics (ONS).

“There are desperate stories behind these figures. People washing in their kitchen sinks because they can’t afford a hot shower; parents skipping meals to feed their kids; disabled people who can’t afford to use vital equipment because of soaring energy bills, said Dame Clare Moriarty, chief executive of Citizens Advice.

‘I can’t do much more’

Health analyst Cheryl Holmes, a mother-of-two, said she was trying to keep her living costs down to “as low as possible” by spending less on food and clothes, and cancelling TV subscriptions.

“I’ve already for several years been turning the lights off in each room, setting the heating on a timer, making sure I’m using a full dishwasher and washing machine and I’m running out of ideas.

“It’s a battle and it seems like there’s not really much more that I can do.”

A higher energy price cap – which is the maximum price per unit that suppliers can charge customers – kicked in last month, meaning homes using a typical amount of gas and electricity are now paying £1,971 per year on average.

Up until now households of all incomes had faced similar rates of inflation, but the poorest are now being hit hardest by rising prices due to them having to spend far more of their household budgets on gas and electricity, think tank the Institute for Fiscal Studies (IFS) said.

The ONS, which publishes the UK’s inflation rate, said the rising cost of raw materials for food products, transport equipment and metals meant prices were climbing in goods leaving factories as manufacturers passed on higher costs.

“All items” on the menus of restaurants and cafes increased last month, which the UK statistics body said was due to the VAT rate for hospitality returning to 20% in April, after being cut to 12.5% to aid businesses recovering from the pandemic.

Meanwhile, average petrol prices stood at £1.62 per litre in April 2022, the highest recorded by the ONS, compared with £1.26 per litre a year earlier.

Inflation is the rate at which prices are rising. For example, if a bottle of milk costs £1 and that rises by 9p, then milk inflation is 9%.

Prices have been rising for months, as fuel, energy and food prices surge higher due to the pandemic and Ukraine war, and wages are failing to keep pace.

The ONS estimated inflation is now at its highest level since March 1982, when it stood at 9.1%.

The Bank of England warned earlier this month the cost crunch is set to leave the UK on the brink of recession, with inflation peaking at over 10% later this year amid further expected energy bill rises in October.

April’s astronomical rise in inflation is no less shocking, even given it was predicted.

As the Bank of England Governor Andrew Bailey has said these sort of rises hit the poorest the hardest, April’s 9% rise is an average across the population. The really painful issue is that this rate is on course to get higher over the course of this year.

And only this week, Mr Bailey acknowledged that there was “not a lot” the Bank could do about four-fifths of the anticipated rise, imported from globally rising prices of energy and food.

The question now is how quickly will this come down from these highs over the next two years. Economics is a prisoner of geopolitics here. But as inflation gets to double digits, workers, consumers, and companies are more likely to start to factor a big fat round number in their expectations of price rises into the future.

So numbers of this magnitude create acute social issues. When the price rises are so widespread and visible in the energy direct debits and prepayment meters of every single households, it also creates a macroeconomic problem, draining the economy of spending power, and slowing it down to a halt, or worse. So the government will face pressure to do more.

And when this is hitting the whole world at the same time, the economy faces territory not seen for a generation.

With households under increasing pressure, there are growing calls for the government to do more to help.

Commenting on the latest figures, Chancellor Rishi Sunak said the government “cannot protect people completely” from rising inflation, which he said was a global problem.

He said he was “providing significant support where we can and stand ready to take further action”.

But Labour’s shadow chancellor Rachel Reeves said that the news was “a huge worry for families already stretched”.

“We can’t wait any longer for action from this out-of-touch government,” she said.

Labour has called for a one-off “windfall” tax on energy companies to help ease the pressure on people’s finances, but the government has only threatened such a move if firms do not invest enough cash into new UK projects.

The cost of living is already seeing people spending less money and cutting down on car journeys due to high fuel costs.

It led to the ONS revealing last week that the UK’s economy shrank in March, which has prompted analysts to warn that the country could fall into recession later this year.

Bank of England faces criticism

The Bank of England’s response to rising inflation has been to raise interest rates, putting them up four times since December. The idea is that when borrowing is more expensive, people will have less money to spend. As a result, they will buy fewer things and prices will stop rising as fast.

The Bank has faced criticism for not doing enough to tackle the rising cost of living. But this week the governor defended its response and insisted inflation was being driven by global not domestic forces which meant the Bank had less scope to control it.

However, the UK now has a higher rate of inflation (9%), than any of the G7 countries, including Germany (7.4%) and France (4.8%).

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown said higher prices in the UK risked becoming more embedded due to wages “spiralling upwards” as firms fight for talent.

There are currently more job vacancies than unemployed people in the UK for the first time since records began, partly because many people dropped out of the workforce during the pandemic.

Ms Streeter said prices across hospitality and recreation industries were now at a 30-year high.

“So far companies have succeeded in passing on higher costs to customers keeping margins resilient, but worries do linger about just how long consumers will continue to pay the price,” she added.

-

- 2 hours ago