The Bank of England has warned of a “material risk” to financial stability as it made a fresh emergency move to try to calm investors.

It said it would buy more government bonds to try to stabilise their price and prevent a sell-off that could put some pension funds at risk of collapse.

It is the third time the Bank has had to step in since the government’s mini-budget sparked alarm among investors.

The chancellor promised huge tax cuts without saying how he would fund them.

The prime minister’s spokesman said she “remained confident” that her plans would boost growth and that she was in regular contact with the Bank.

On Monday, in a bid to reassure investors Chancellor Kwasi Kwarteng said he would bring forward his economic plan where he will spell out how he plans to pay for the tax cuts and provide an independent forecast on the UK economy’s prospects.

Ahead of this the Bank had also said it was prepared to double the amount of bonds it was buying to help support their price, but reiterated it would end this support as planned on Friday.

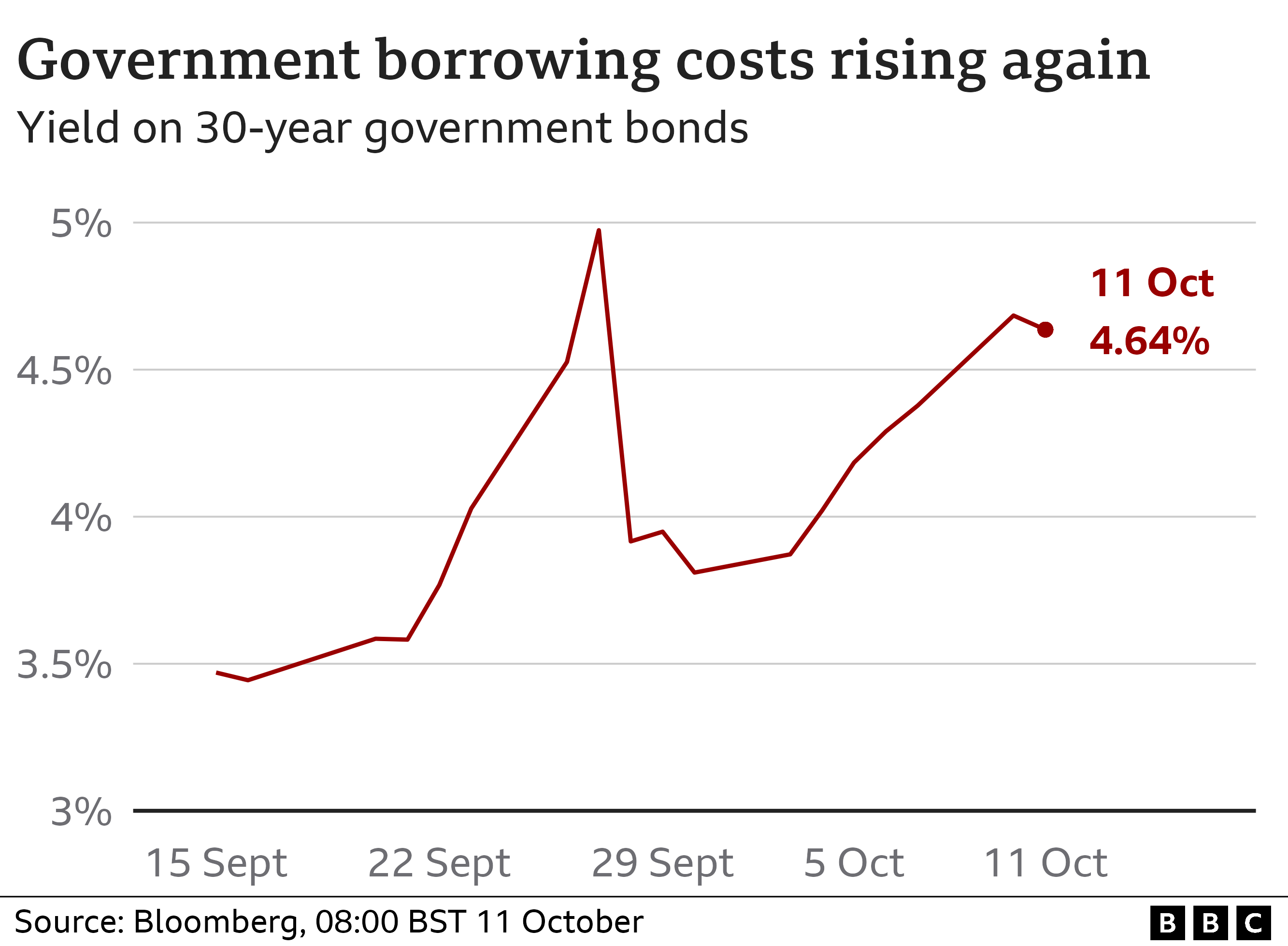

Government borrowing costs rose sharply despite these actions as investors continued to remain wary of buying bonds.

Shadow chief secretary to the Treasury Pat McFadden said the fact the Bank had been forced to step in for a second day running created “renewed pressure for the chancellor to reverse his budget.”

The government raises money it needs for spending by selling bonds to investors. The Bank first stepped in on 28 September, when days after the mini-budget, investors began demanding higher rates of interest on those bonds and government borrowing costs surged to worrying levels.

The market turmoil had forced pension funds to sell bonds due to concerns over their solvency, but this threatened to create a downward spiral in bond prices as more were offloaded and had left some pension funds close to collapse.

By buying bonds, the Bank is hoping to help keep their price stable and prevent investors selling them.

The turmoil has fed through to the mortgage market, where hundreds of products have been suspended due to concerns about how to price these long-term loans.

Last week, interest rates on typical two and five-year fixed rate mortgages topped 6% for the first time in over a decade.

Under pressure from its MPs to change course, the government has been forced into a series of embarrassing climbdowns.

Among other things it had to U-turn on a promise to scrap the top rate of income tax.

On Tuesday, the Institute for Fiscal Studies (IFS) think tank warned that Mr Kwarteng would have to make “big and painful cuts” of up to £60bn to balance the books when he announces his economic plan on 31 October.

Mr Kwarteng will take questions from MPs this afternoon in the Commons for the first time since being appointed.

“A material risk to UK financial stability” are words the Bank of England uses rarely, a warning of a threat to the financial system it can’t confidently ignore. It’s even more rare for several senior Bank executives to have indicated part of the blame for the turmoil may lie at the government’s door, the result of domestic policy.

They’re not alone. The sharp rise in the cost of new government borrowing – the interest on those bonds – reflects an anxiety amongst investors that its tax-cutting plans risk the UK overstretching itself. And it’s pensions funds and borrowers who are hit by the fallout.

It’s the Bank who – again, a rare event – had to try to ease their pain. But it’s made it clear that the medicine is a stop gap – and the lingering unease in the market emphasises it’s ultimately looking to what it sees as the source of its unease – the chancellor’s approach – for a remedy.

Resolving this crisis of faith will ultimately depend on what the chancellor unveils in his Hallowe’en plan. If the IFS is right, the price of restoring credibility could involve upwards of £60bn worth of cuts to public spending.

Explaining its intervention on Tuesday, the Bank of England said government bonds had seen a “significant re-pricing” since the start of the week and warned there was a risk of a fresh downturn in markets.

It said it would now buy a wider range of bonds as well as continue to buy bonds as part of the original emergency measures it launched on 28 September.

Sir John Gieve, a former deputy governor for fiscal stability at the Bank, said the Bank was primarily stepping in to protect pension funds, many of which hold government bonds as investments.

However, he said the “underlying problem” was that markets did not believe the government would be able to cut spending enough before its growth measures took effect.

“The underlying problem came on the back of the announcement of huge amounts of extra borrowing and without a clear plan on how to pay for them,” Sir John told the BBC.

“And the latest speculation on that is that in order to make the books balance [Mr Kwarteng] will have to promise [billions of] spending cuts. It’s one thing to say that, but can he actually deliver that?”

Prime Minister Liz Truss has said that around £43bn of promised tax cuts will boost UK economic growth and therefore pay for themselves.

The chancellor has also committed to publishing an independent forecast of the UK’s economic prospects by the OBR, the independent budget watchdog, at the same time as his economic plan on 31 October – something he declined to do with his mini-budget.

But Ms Truss faces a potential rebellion from her MPs after declining to say whether she would increase benefits in line with inflation next April.

It is thought that increasing benefits in line with wages instead could save the government £5bn.

-

-

13 hours ago

-

-

-

1 day ago

-