The boss of the Bank of England has said a bond-buying scheme to stabilise pension funds must end on Friday, despite pleas to extend it.

The scheme must end for the sake of UK financial stability, Andrew Bailey told BBC News.

He said that managers have got to make sure that their funds are resilient.

Earlier the Bank of England made a fresh bond-buying move to try to calm markets.

Mr Bailey told the BBC on Friday: “We are doing everything to preserve financial stability, you have my assurance on that.”

But he said pension funds have “an important task” to ensure they are resilient.

“I’m afraid this has to be done, for the sake of financial stability,” he said.

Earlier, he had told fund managers: “You’ve got three days left now. You’ve got to get this done.”

The pound dropped sharply against the dollar to below $1.10 after Mr Bailey’s statement.

After the tax cuts were announced in September, sterling fell to a record low of $1.03, but then regained ground while remaining volatile. It was trading above $1.11 before Mr Bailey’s speech.

Pensions risk

Prime Minister Liz Truss and Chancellor Kwasi Kwarteng are facing pressure over fiscal plans made in their first weeks in Downing Street.

On 23 September, the government announced a series of measures, dubbed a mini-budget. It pledged £45bn of tax cuts to try to boost economic growth, but the amount of government borrowing required made investors question whether the plan was sustainable.

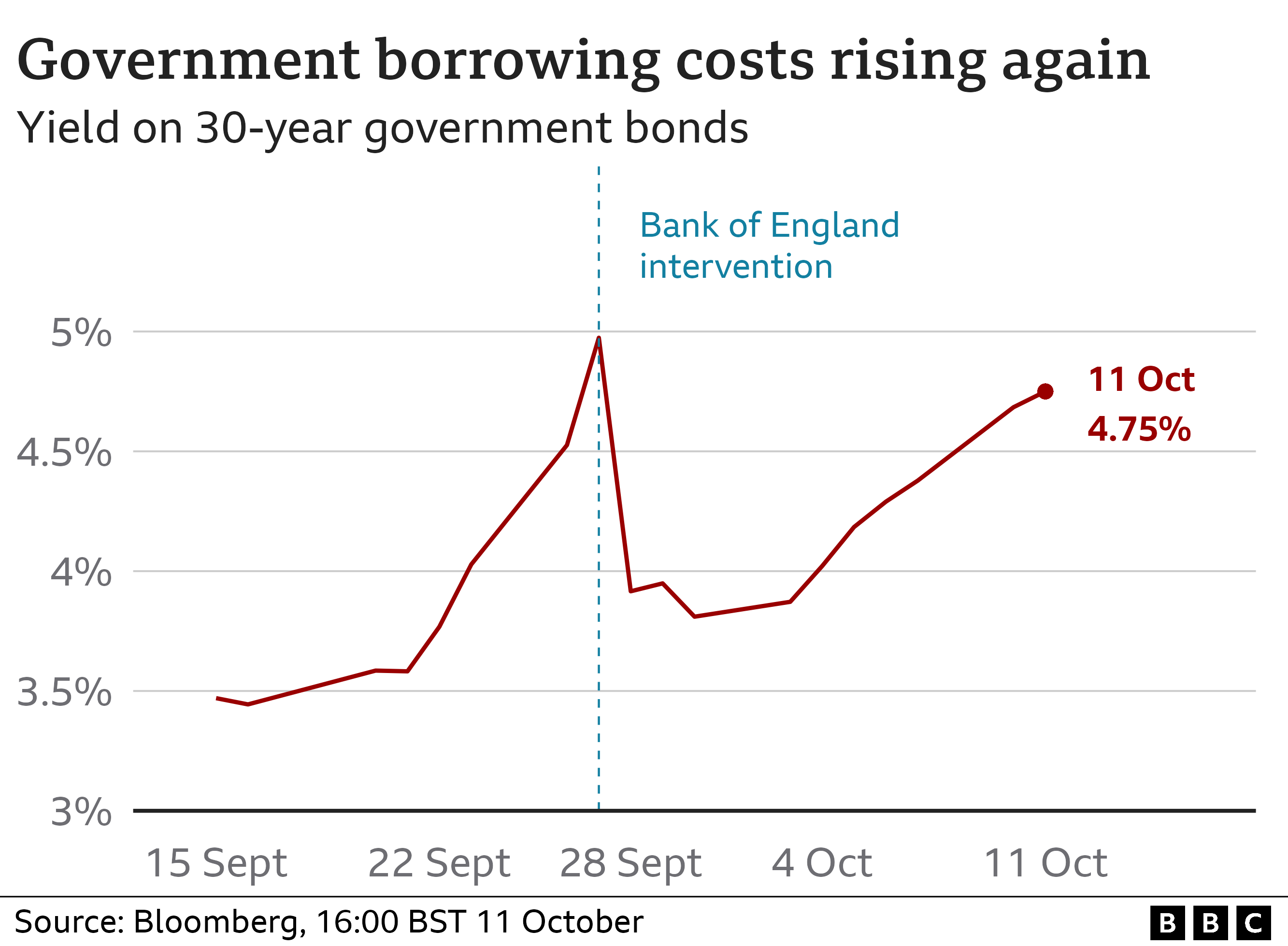

After the statement, the pound hit a record low, and investors wanted a much higher return for buying government bonds, causing some to drop sharply in value.

Certain types of funds in the pension industry were forced to start selling bonds in a way which could have led to their collapse.

On 28 September, the Bank stepped in to buy government bonds, explaining its decision was driven by concern over “a material risk to UK financial stability”.

The Bank is due to end its emergency bond-buying programme on Friday, but a pensions industry body urged the Bank on Tuesday to extend the support due to fears of further market turmoil.

Mr Bailey was surprisingly blunt given sensitivities in the market, but the Bank always said its support to the UK government debt market was going to be temporary.

The giant market funds that had applied financial wizardry to the normal boring world of pension funds have three days more of support, before having to “get it done” he said, dashing hopes of an extension.

Sterling slid again on the comments against the dollar, to below $1.10 for the first time this month.

The comments were no slip of the tongue.

Afterwards, approached by BBC News about them and their impact on the pound, the governor reassured people and pensioners, but went out of his way to say the City giants now had to arrange their affairs.

The message will have an impact on the government too.

At times of previous high borrowing and fiscal stress, the Bank has bought up bonds for long periods of time.

The clear consequence of this position is that will not happen on this occasion.

The Bank will not stand in the way of the market pushing up the effective cost of government borrowing as a response to uncertainty over its economic policy.

This further increases the pressure on the government, and the chancellor, to come up with an economically credible and politically viable debt plan, and quickly.

But Mr Bailey said that the Bank’s help would stop at the end of the week, and urged pension funds to make sure that riskier investments were offset by less risky ones.

However, former pensions minister Steve Webb, who now works for pension consultants LCP, said he thought Mr Bailey may have to extend the help.

“It’s not a fantastically good thing for pension funds to be furiously selling assets over a two-week period, so it’s perfectly possible, although a lot has been done, that more help will be needed from the Bank on Friday,” he told BBC Radio 4’s The World Tonight, adding: “We are in uncharted territory”.

The government had earlier said it remained confident in its tax cuts plan, with Mr Kwarteng telling MPs he was “relentlessly focused on growing the economy” and “raising living standards”.

But Labour’s shadow chancellor Rachel Reeves said: “This is a Tory crisis that has been made in Downing Street, and that is being paid for by working people.”

Former IMF deputy director Mohamed El-Erian told BBC News that the economy was on “shaky ground”.

He said financial systems going into turmoil “can cause a lot of damage”.

The government raises money it needs for spending by selling bonds – a form of debt that is paid back plus interest in anywhere between five and 30 years.

But the sharp rise in the cost of new government borrowing – the interest on those bonds – reflects an anxiety among investors that the UK’s tax-cutting plans make it a risky investment bet.

By buying bonds, the Bank is hoping to help keep their price stable and prevent investors selling them in what it likened to a “fire sale”.

The Pensions and Lifetime Savings Association, which represents schemes managing about £1.3tn of retirement money, said many funds wanted the bond-buying programme to last until the chancellor delivered his economic plan on 31 October.

The Treasury said it was “working closely with other UK authorities to monitor the markets as is usual”.

-

-

1 day ago

-